This post may contain affiliate links. Please see my advertiser disclosure for more details.

Here’s a type of conversation I have with a decent amount of regularity when I talk to friends and family about how Ken and I travel first class for little or no money. (Like Turkish Airlines Business Class, JetBlue Mint Class, AirBerlin Business Class, Cathay Pacific First Class, and more!)

Neighbor: Wow, yeah, this points thing sounds amazing! I’d love to fly first class for basically free! What credit card do you recommend for a newbie?

Me: Oh, there’s a bunch, and it depends on your upcoming travel goals or plans. But maybe X Card or Y Card.

Neighbor: Great, I’ll look into those.

A few weeks later, I bump into the neighbor during an evening walk …

Me: Hey! Did any of those credit card recommendations catch your eye?

Neighbor: Well, I looked them up, and the card you’re recommending has a 26.2% interest rate. Not exactly the “free”travel I was hoping for.

Me: [Perplexed look on my face as I try to hide my eyeroll]

Neighbor: What is the interest rate on your card?

Me: I dunno, it’s never mattered to me …

Neighbor: [Looks at me like a fiscally irresponsible human being. A mix of disappointed and flabbergasted.]

Me: … You know, you don’t have to pay interest on your credit card as long as you pay off the statement balance in full every month. That’s what I do. And that’s why I don’t have to pay attention to what my interest rate is.

Neighbor: Are you sure you’re not mixing that up with a debit card? Because debit cards are the only types of cards that don’t charge interest.

Me: [Thinking, this person is nearly 40. How have they made it this far in life with such a fundamental lack of understanding of how credit cards work.] Yes, I’m sure it’s a credit card. And no, I don’t pay interest because I pay off the statement balance in full every month.

Neighbor: Oh, you must have one of those zero percent introductory rate cards.

Me: [Considers jumping in front of oncoming car to end the pain.] I promise, if you pay off the statement balance in full every month, you don’t get charged interest on those charges.

Neighbor: But who has time to track precisely what you’ve put on that card that month to avoid the interest charges!

Me: It’s right there on your bill! It says STATEMENT BALANCE. If you pay that amount, by the due date, viola, there’s no interest charges.

Neighbor: [Obviously not believing anything I’m saying]. Yeah, it just doesn’t seem worth it.

Me: [Thinking, I tried. I tried. Their loss that they won’t get the free travel that they sounded so interested in. Don’t let it bother you. BUT BUT WHY DON’T PEOPLE KNOW HOW CREDIT CARDS WORK.]

This bothers me way more than it should

This dialogue (dramatized and aggregated from multiple conversations for sure, but has played out on some level or another multiple times in my life), is here to illustrate something that I need to get off my chest. It’s something that bothers me WAY more than it should. And, it’s something that I always think should “go without saying,” but clearly it doesn’t. So, I’m going to state this in as many ways as I can.

You can have a credit card AND use that credit card

and NOT pay interest.

Phrased another way:

Having a credit card does not mean you always pay interest on the charges.

I repeat. Using a credit card for purchases DOES NOT MEAN YOU HAVE TO PAY INTEREST ON THOSE PURCHASES.

Do not let misinformation guide your financial decisions

As an obvious disclaimer, this is not for people who do carry balances on their credit cards and pay interest or for people who know they can’t be responsible with credit cards. (Meaning putting more on the card in one month than you’d be able to pay off the next month).

This advice / revelation is more geared for people who have never had a credit card, or choose to use their debit card because they don’t want to get “charged interest.”

And I’m not trying to “shame” anyone who doesn’t know that credit cards do not automatically mean paying interest. We’ve all been guilty of financial misconceptions in our life. Hell, I didn’t start contributing to a Roth IRA until I was 26 years old despite having heard repeatedly that it was a fantastic savings vehicle. I just honestly had no idea how to open one. (I remember my internal dialogue going something like this: “A brokerage? What’s that!?! That sounds expensive! So surely I don’t need a Roth IRA then, it can’t possibly be worth it.”) So, there. We can all learn to improve our financial futures!

This happens a LOT

Another scenario I recently ran into: A woman on a local Facebook group said she never had a credit card and was looking to build her credit. I replied to the post, recommending a secured credit card, or perhaps a store credit card, and reiterated that she should pay off the balance every month. I was LAMBASTED in the replies to that post. Folks saying that store credit cards charge way too much interest. So, I reminded them that I had stated the original commenter should pay off the balances each month. Didn’t matter, they said. I know it shouldn’t surprise me any more that people don’t know how credit cards work. But, it does.

How do you track your “Statement Balance” (Hint! It’s on your statement!)

I put EVERY POSSIBLE EXPENSE on a variety of credit cards each month. Groceries, dining out, shopping, Amazon, travel. If it’s an expense, I put it on one of my many credit cards. And no, I don’t pay any interest.

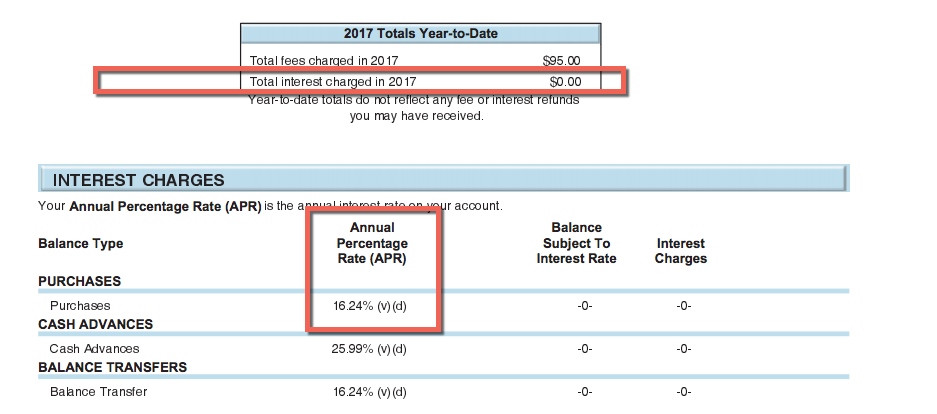

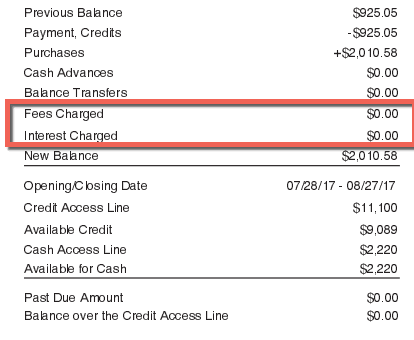

For the purposes of this post, I went through some of my recent credit card statements. My Chase Sapphire Preferred Card has a 16.24% interest rate. I’ve had that card since 2012. On my statement that ended last month, my balance was $925.05. I was charged $0.00 in interest. The previous month my balance was $2667.12. I was charged $0.00 in interest. Why? Because I paid off the balance in full. You can see that for ALL OF 2017 SO FAR, I have not been charged any interest. (Yes, I pay a $95 annual fee, by choice, because well over $95 in value from the card each year. But, there are plenty of other cards that I don’t pay fees for, or cancel prior to the annual fee coming due if I don’t get enough value from the card).

Okay, okay. So some people might, after some explanation, “get” that. But how do they keep track of whether they’ve paid the statement balance in full? Some people seem to think that they have to manually keep track of how much they’ve put on the card. Nope. All you have to do is look on your statement for the spot that says “statement balance” or “balance due” or “new balance.” That’s not the same as the minimum payment. If you only pay the minimum payment (or, frankly, anything shy of the statement balance, then yes, you’ll get charged interest).

A Small Experiment

Don’t believe me? Take an existing credit card you have that doesn’t have a balance on it. Just charge $5 or $10 worth of stuff to it this month. Next month, when your bill comes, pay the “statement balance” amount on or prior to the payment due date. You’ll see that you won’t get charged any interest.

And just because someone will bring it up as a “danger…”

And what about the “risk” of being late with a payment and getting charged interest? Well, this can be avoided by setting up automatic payments to pay your statement balance on or before the due date. But, once I applied for a new credit card and forgot to set up automatic payments right away. Lo and behold, I missed the credit card due date and was smacked with interest charges AND a late fee to boot. Well, a quick call to the bank to explain that I pay my statement balances in full every month and had meant to set up an automatic payment, they refunded the interest charges and the late fee. In my experience (and based on reading various comments on the points-and-miles community), banks will generally refund these once per year or so. That’s usually all it takes for me to learn my lesson for the rest of the year!

Do you use credit cards and not pay interest? Do you also have these types of conversations?